Introduction

Jewelry is widely considered to be a liquid asset for investors. Though this type of investment may not fetch huge returns, it does come with several benefits and advantages. Here are some of the reasons why jewelry can be an attractive option for those wishing to invest their money in something that is easily convertible into cash.

1. Potential Returns on Investment: Investing in jewelry is not as risky as other types of investments, such as stocks and shares, thus eliminating much of the uncertainty associated with investing. Depending on the quality of the piece and rarity, jewelry investments can offer good returns.

2. Portability: Jewelry pieces are easily transportable and do not require a great deal of space when compared to other asset classes such as real estate or art works which take up large amounts of space. This makes them perfect for travelling investors who want to store their assets safely while moving from one destination to another.

3. Divisibility and Liquidity: Jewelry provides high levels of liquidity by allowing the investor to quickly convert the asset into cash if they wish to do so. Furthermore, unlike many other asset classes divisible into fractions, like real estate or commodities, gold jewelry pieces can be sold slowly over time without having to find buyers for large portions at once — making it easier for users to liquidate their investments at their own pace without disrupting the market prices too severely.

4. Store of Value: While paper money is steadily losing its value in today’s increasingly inflationary world economy; gold remains a safe store of value due to its constant demand worldwide both by central banks and individuals alike — increasing its relevance over time instead of diminishing it. This makes gold-based jewelry investments ideal for someone looking for security and stability among rising prices, especially during periods when financial assets are being negatively impacted from wider macroeconomic conditions or geopolitical changes that can often result in significant market corrections (e.g., trade wars, pandemics).

Factors Affecting Jewelry Prices

Jewelry is considered to be a liquid asset because it has a relatively high resale value and can be quickly acquired or sold. The liquidity of jewelry depends on the market demand, quality, and variety of pieces available. Jewelry price movements are affected by influences including economic conditions, industry trends, global demand, raw material and labor costs, advertising campaigns, and designer collections. The frequency and magnitude of fluctuation in jewelry prices vary greatly across categories based on these factors. For example, demand for luxury diamond rings could remain steady over long periods of time. However more affordable fashion jewelry can experience significant volatility due to trends in style and color preferences among consumers.

Types of Jewelry as Liquid Assets and Their Pros and Cons

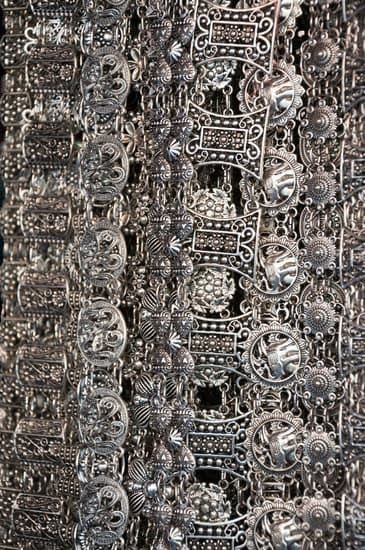

Jewelry is considered a liquid asset because it can be converted into cash quickly and easily. Types of jewelry that fall into the liquid asset category include diamonds, precious metals (e.g., gold and silver), fine watches, and designer jewelry. Each type has its own pros and cons when it comes to liquidity.

Diamonds are one of the most sought-after forms of jewelry in the world, making them highly liquid assets. However, they require considerable expertise to properly assess their quality and value, which can be an obstacle to quick sale. Additionally, diamonds may not hold their value in times of economic downturns.

Gold and silver are two of the most stable investments when it comes to liquidity because their prices tend to remain stable even when other assets decrease in value. Jewelry made from these metals require appraisals as well in order to determine their quality and worth on the open market. The downside is that gold or silver jewelry must be sold through specialized channels such as pawnshops or online auction sites for optimal returns on investment.

Fine watches are another very liquid asset due to their timeless appeal among collectors throughout the world, yet assessing their value requires expertise as well as research into prevailing fashion trends in watchmaking circles before sale if higher returns are desired.

Finally, designer jewelry enjoys high liquidity thanks largely due to branding awareness; collector’s items by major couturiers may command far higher prices than simpler gold or diamond pieces not backed by big names. However due to the laccolith of counterfeiters active nowadays, buyers must be especially careful not to buy faulty merchandise with no luxury pedigree attached at any price!

The Risks and Benefits of Investing in Jewelry

Jewelry can be considered a liquid asset, as it can easily be converted into cash. It is a highly valuable commodity and has the potential to bring consistently high returns on investment. However, jewelry investing also comes with some drawbacks.

The advantages of investing in jewelry include the ability to make substantial profits quickly as changes in market value can occur rapidly due to supply and demand. Jewelry commands respect as a form of expression and wealth, making it a desirable item for investors who are looking for more than just financial gain. Additionally, individual pieces often hold sentimental value, increasing their collectability over time.

Despite this, there are certain risks associated with investing in jewelry that must be weighed up carefully before taking the plunge. As its price is driven by intangible factors such as fashion trends and aesthetics rather than actual intrinsic value, it can be vulnerable to market volatility and rapid shifts in demand. Furthermore, investments of this type are subject to wide margins and sellers may take advantage of buyers who lack knowledge or expertise in the field. Therefore it’s important for prospective investors to conduct extensive research into jewelry markets before committing any funds towards this kind of venture.

How to Find Quality Jewelry to Invest In

Investing in jewelry is a great way to acquire a liquid asset as it has the potential to appreciate significantly in value over time. Quality jewelry pieces can hold their value if carefully selected and cared for, providing an important asset you can use for life or pass down through generations. To find quality jewelry to invest in, there are a few tips you should keep in mind. First, consider whether you are looking for precious stones such as diamonds, other gemstones such as sapphires or rubies, or gold and silver pieces. Once you determine the types of jewels that make sense to your investment journey, research select jewelers who sell certified stones of the highest quality and authenticity. As rare pieces tend to fetch higher prices at resale, look into buying limited edition collections so you can ensure they will maintain their value throughout time. Also be sure that each piece meets legal weight standards and that the appraisal paperwork provided comes from a reputable source to guarantee its accuracy and validity. Taking these steps will give you peace of mind knowing that your investment is backed by quality workmanship and can be used for both financial enjoyments now and also provide security for later years.

The Value of Jewelry as a Liquid Asset Over Time

Jewelry can be an excellent way to preserve wealth over time. Depending on market conditions, the value of jewelry can either increase or decrease over time; however, for many types of antique jewelry, iconic pieces and certain precious metals, the value generally holds relatively steady.

Unlike stocks, bonds and other investments that may fluctuate due to day-to-day stock market events, jewelry is seen more as a long-term asset. This makes it a good option for those looking for an investment that will retain its value should there be an economic downturn. For example, during turbulent economic times such as recessions, those who bought gold and silver jewelry in the past often found the value of their pieces had actually increased when the recession – and subsequent fear among investors – settled down.

Additionally, valuable pieces of jewelry are often seen as works of art that provide emotional enjoyment in addition to financial security. They can come with a certificate of authenticity ensuring their worth over time or instant appraisal upon purchase. Jewelry is also easy to transport and exchange relative to other types of assets such as real estate or artwork; therefore, it can act as a form of currency which makes it especially appealing as an illiquid asset. Finally, since jewelry is durable and usually quite portable it remains ideal for passing down through generations within families or simply owning as a keepsake.

How to Maximize Profit When Selling Jewelry as a Liquid Asset

Jewelry can be a great liquid asset because it is a highly desirable item that typically holds its value very well. To maximize profit when selling jewelry as a liquid asset, it’s important to do research on the current market trends and understand what type of jewelry is most popular. It is also important to create an effective marketing strategy, such as utilizing digital channels like social media or email campaigns to reach potential buyers. Additionally, pricing the items correctly from the outset is key – setting the price too high might mean fewer sales and lower profits whereas reducing it too much could result in missing out on potential revenue altogether. Finally, providing clear and honest information about each piece can also help capitalize on greater profit opportunities as buyers are more likely to trust honest sellers with their money.

Conclusion

Yes, jewelry can be considered a liquid asset. Many people are opting to invest in high-end gold, silver, or diamond jewelry pieces due to their increasing values over time. When looking at returns in the long term, acquiring unique gems or precious metals can yield an excellent return on investment and offer financial stability for those who sought out this kind of asset.

Jewelry is a particularly attractive option for those seeking short-term liquidity. Pieces of jewelry can be sold almost immediately on the open market, often within a few days or even hours after listing them for sale. Furthermore, since luxury jewelry is generally seen as being of greater value than other traditional forms of invested capital such as stocks and bonds, buyers are usually willing to pay fair market prices when competing bids exist. This means investors can benefit from attractive returns in a relatively short period of time with minimal risk. As well as turning around investments quickly, there also exists potential for sizable long-term gains depending upon the size and type of the collection amassed. Additionally, luxury jewelry often carries aesthetic value that one may appreciate without seeing any dollar signs attached. This makes it an ideal addition to anyone’s portfolio due to the unique pleasure it provides beyond just dollars and cents.

Welcome to my jewelry blog! My name is Sarah and I am the owner of this blog.

I love making jewelry and sharing my creations with others.

So whether you’re someone who loves wearing jewelry yourself or simply enjoys learning about it, be sure to check out my blog for insightful posts on everything related to this exciting topic!